You’re being bamboozled.

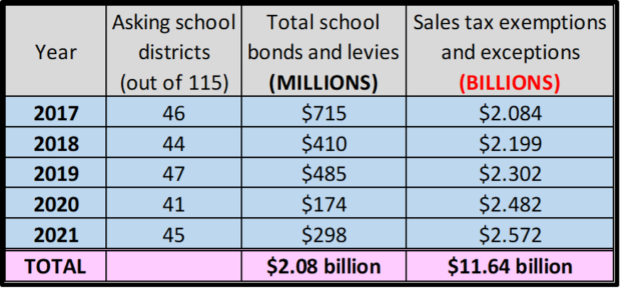

Republican Party leaders repeatedly say you should be afraid of “tax-and-spend Democrats.” Instead, there are over two billion reasons you should be afraid of them. Over the last five years, the legislature has forced school districts across the state to float nearly $2.1 BILLION in local bonds and levies. This includes many conservative, rural school districts across the state that are loathe to impose property tax increases on voters.

What the majority party doesn’t want you to know is the role they’ve played in raising your property taxes. The legislature is constitutionally bound to adequately fund the annual operations of all public schools. Local bonds and levies are supposed to be supplemental to that funding. Instead, these bonds and levies have become necessary to fund annual operational costs. The Legislature is picking your pocket to pay for its failure to do the job.

Legislative leaders like to argue that education is over 50% of the state budget and therefore must be contained. What they don’t tell you is how much money the legislature exempts from revenue collection each year – before budgets are set – just in the form of sales tax exemptions and exceptions alone. Many of them have been on the books for decades. They are rarely reviewed and never expire.

Note in the chart below that if only 18% of the $11.64 billion in exemptions can’t be justified, that would have paid for every bond and levy requested statewide for the last five years. And this doesn’t include additional tax exemptions, such as tax incentives and special property tax breaks awarded to selected entities. This is how the Legislature has been increasing your property taxes.

Source (bonds and levies): Idaho Education News Source (sales tax exemptions): Legislative Services Organization, Idaho Legislature

But the situation is even more insidious. If you throw a frog into a pot of boiling water, the frog will immediately jump out. But if you put a frog in lukewarm water and slowly increase the temperature, the frog will not perceive the danger and eventually be cooked to death. Voters are being lulled into the notion that annual school bonds and levies are the norm. They are not. Truly supplemental bonds and levies should probably occur no more than about once every 5-10 years – not every year. When it comes to the Legislature’s control of the education budget – you are the frog!

And if the same people who created and perpetuate this situation are continually re-elected, the next generation will be on the menu.

Recent Comments