I visit with my District 15 constituents at their door nearly every day to stay current with what concerns them the most. The top two issues almost everyone brings up are education funding and managing growth. Both issues are impacted by a common underlying concern – fiscal management.

How can legislators fund the state’s future needs without continually reaching into your pockets? It may be time to revisit some fiscal policies that haven’t changed in decades. One of those policies is the fiscal elephant in the room that no one wants to talk about: sales tax exemptions, which are rarely reviewed and never sunset.

Voters are frustrated with the legislature increasing their property taxes and rents by forcing school districts to continually float bonds and levies to close the education funding gap. Last March alone, over 40% of Idaho’s school districts had to ask voters for nearly half a BILLION dollars in bonds and levies. Many people on fixed incomes are worried about losing their home because they can’t afford to pay increases in their property tax.

Voters are also concerned about the failure of government to adequately manage growth. Anyone who drives a car knows that significant investments in transportation infrastructure are needed to maintain existing roads and bridges as well as planning for growth. When you include the gas tax and a grocery tax never goes away, many people are struggling to make ends meet.

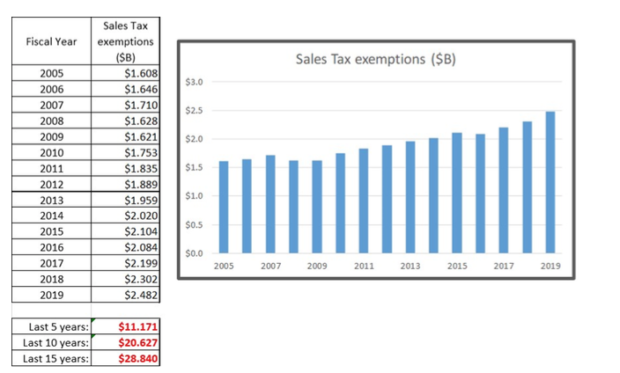

In 2019, the legislature exempted $2.48 BILLION from revenue collection in the form of sales tax exemptions and exceptions – much of them specially granted to individual interests or industries, this was greater than the entire 2019 education budget. In fact, over the last 15 years the legislature chose to not collect a whopping $28.8 BILLION in revenue. A small percentage of that money could cover the cost to maintain and build much needed roads and bridges, provide competitive compensation for teachers, and pay off school bonds and levies which could then lower property taxes and rents. We might even be able to finally get rid of the grocery tax.

However, the mere mention of sales tax exemptions within the halls of the state Capitol is immediately met with a litany of reasons why they can’t be touched and shouldn’t be discussed. The perpetual renewal of sales tax exemptions through inaction may have been easier to withstand when Idaho was a smaller, slow-growing state. But today Idaho has the largest population in its history and growth continues at an unpreceded rate. We need fiscal policies that plan for the future, not anchored to the past.

To be clear, we don’t need to get rid of all sales tax exemptions; many of them may make sound economic sense and should therefore be retained. Legislative leaders celebrated Governor Little’s sweeping review and changes to outdated administrative rules and regulations. They should now review decades-old fiscal policies to make sure they are in tune with the future needs of the fastest growing state in the nation.

Sales tax exemptions should be included in such a review. One suggestion is to establish objective criteria for determining if exemptions granted years ago are still delivering a long-term benefit to the state. This is not about picking winners and losers – it’s about recipients making the business case for continuing to receive a tax benefit that is otherwise being subsidized in part by homeowners, renters, and anyone who pays college tuition, buys gas or purchases groceries.

It is time to pay serious attention to the fiscal elephant in the room, which grows larger every year.

Recent Comments