The House Minority Caucus unveiled its “Idaho Working Families Agenda,” a comprehensive plan to deliver tax benefits to working families and boost critical education investments to help Idaho children learn basic skills, including reading.

House Assistant Minority Leader Rep. Lauren Necochea, D-Boise, presented the proposal during a virtual news conference at 10:30 a.m. Wednesday with members of the media.

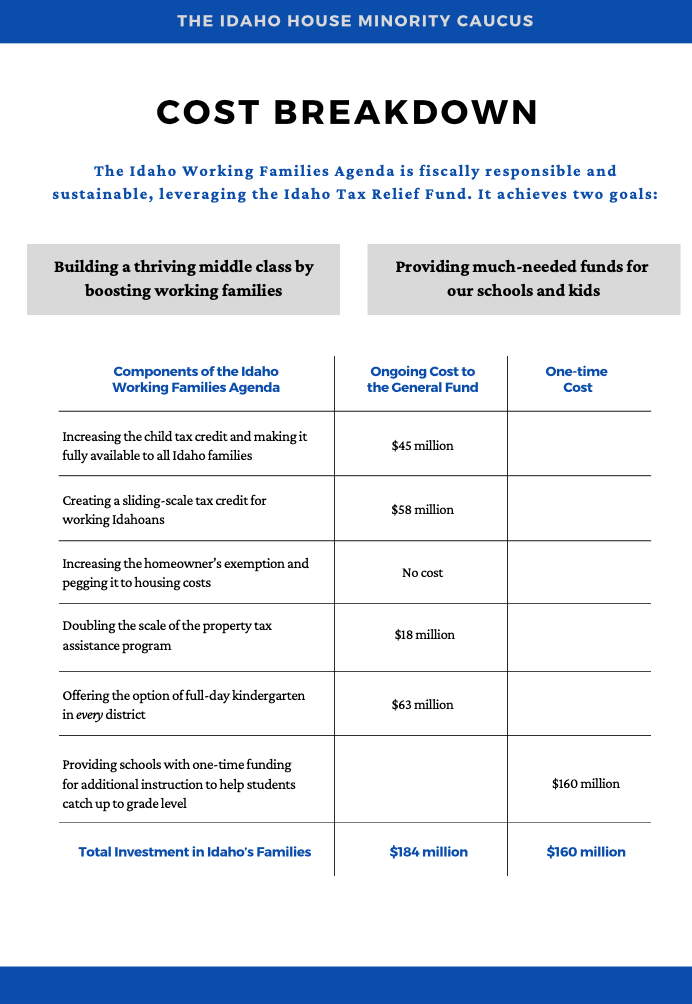

Necochea said the plan is both fiscally responsible and sustainable, leveraging the Idaho Tax Relief Fund. She added it achieves two goals: growing a thriving middle class by boosting working families as well as providing much-needed funds for our schools and kids.

“Our Idaho Working Families Agenda focuses on the Idahoans who have been left behind by decades of lopsided tax policies favoring the wealthy and well-connected. Idahoans shouldn’t need a lobbyist to get a fair shake. It is time to restore balance to our tax policies and finally put Idaho’s working families first,” Necochea said in Wednesday’s conference.

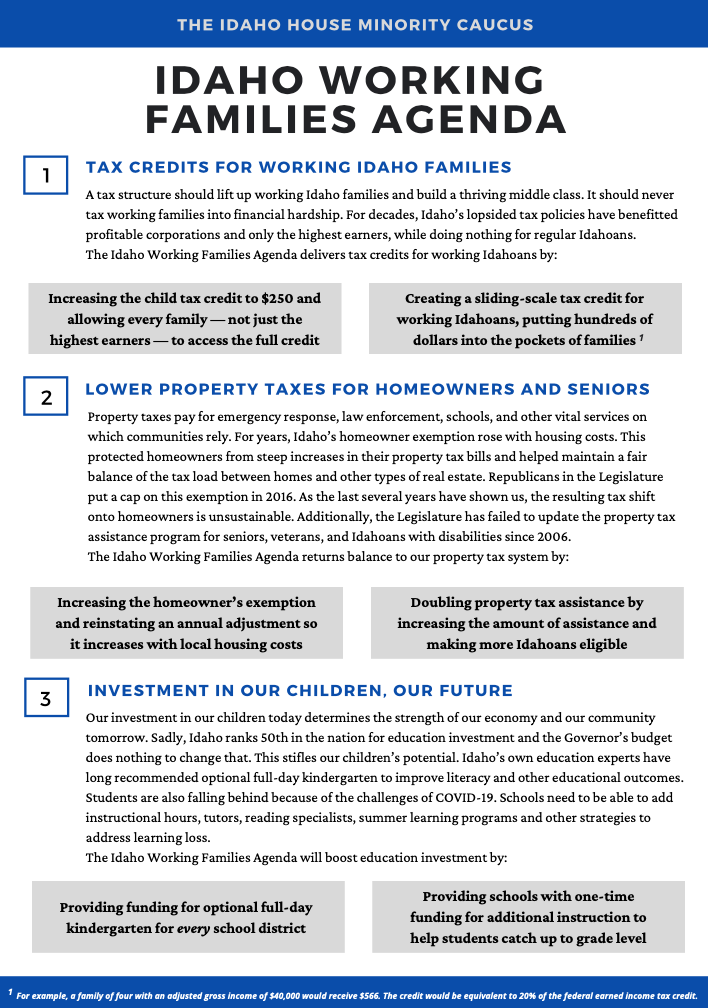

Components of the Idaho Working Families Agenda include:

● Increasing the child tax credit and allowing every family to redeem the full value

● Increasing the homeowner’s exemption and pegging it to local housing costs

● Doubling the scale of the property tax assistance program

● Offering the option of full-day kindergarten in every district

● Providing schools with one-time funding for additional instruction to help students catch up to grade level after a year of learning disruptions due to COVID-19

● Creating a sliding-scale tax credit for working Idahoans

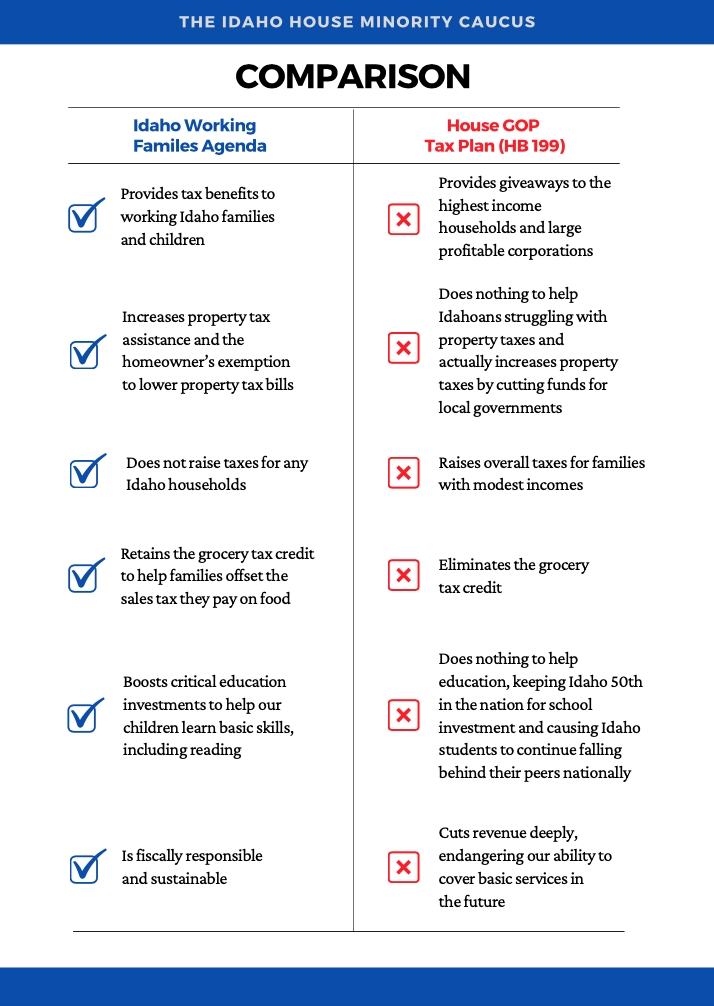

Necochea said unlike the House GOP’s tax plan, House Bill 199, it does not raise taxes for any Idaho households and retains the grocery tax credit to help families offset the sales tax they pay on food. She added it also directs tax benefits to working Idaho families and children, not giveaways to the highest earners and large profitable corporations.

“Our agenda stands in stark contrast to the tax plan that the House GOP leaders revealed yesterday, which focuses on steep tax cuts for profitable corporations and people at the top of the income spectrum. This is the playbook that the Idaho GOP has been following for decades, and it leaves working families behind,” Necochea said. “When we put dollars back into the hands of working families, there is a ripple effect across local economies. As families get needed car repairs, buy groceries, and have their hair cut, those dollars, in turn spur additional economic activity and build wealth across the community.”

“It’s time for us to enact policies that truly address the needs of Idaho’s working families,” added Rep. Colin Nash, D-Boise, who co-authored the plan with Necochea. “This plan delivers results to those who need it most.”

Learn more about the Idaho Working Families Plan: